With the deterioration of the world's geopolitical situation, a large number of normal economic activities has now been highly politicized as a result. These activities include international trade, transnational investment, market access, industrial chain, supply chain, equipment procurement, listing financing, technology transfer, patent use, capital flow and settlement, market space, transnational financial services, science and technology education, personal information collection, personal sanction, and so on. Almost all economic activities under the modern economic system could be restricted, prohibited or sanctioned for alleged "national security" reasons.

When normal economic and trade activities are used as a sanction tool, economic activity then is being "weaponized". The United States is the initiator and the major promoter of this trend whereas China is the biggest target of the U.S. policy adjustments. In the course of U.S.-China trade disputes and geopolitical frictions between 2018 to present, each of the above mentioned areas has been used by the United States as a "weapon" against Chinese companies and individuals. Generally speaking, the United States, among all the Western countries, is able to use sanctions as "weapons" arbitrarily because of its global hegemony. Specifically, the United States has two outstanding advantages: one being technological, and the other, financial.

With its long-term leadership in scientific research and technological innovation, the United States has established superior technological advantages in many industrial fields, and has made a series of intellectual property rules and technical barriers. In addition, it has also promoted the establishment of "clubs" that restrict technology transfer to socialist countries. First, there was the Coordinating Committee for Multilateral Export Controls, then there was the Wassenaar Arrangement. Under such a backdrop, the U.S. uses its technological superiority to suppress potential competitors (such as China) or hostile countries, and it has every means to do so, from tools to its many allies. In addition, the financial advantage of the dollar system is a weapon that the United States can wield to frighten other countries, and it can be used with technical weapons or simply on its own.

There are incidents of "technology weaponization" being used to attack opponents happening right now, the U.S. chip sanction on Huawei is such an example. We believe that the impact of the U.S. chip sanctions on Huawei is very significant. The main effects are as follows: (1) Impact on Huawei's important source of income. In 2019, Huawei's smartphone shipments exceeded 240 million units, and its consumer business sales revenue was RMB 467.3 billion, a year-on-year increase of 34.0%, accounting for 54% of total revenue. The consumer business, chiefly those of smart phones has provided Huawei with important financial resources. Yet, the sanctions on chips will have a major impact on Huawei's revenue, forcing Huawei to adjust its business structure. (2) The IC design of HiSilicon was also hit by the sanction, which put China's strongest IC design company in trouble, the design team in particular which was formed more than 10 years ago will face a crisis, which will in turn significantly weaken China's IC design capabilities. (3) While the United States sanctions Huawei, it also uses geopolitical alliances to expel Huawei's products and businesses around the world, which has had a significantly negative impact on Huawei's years of efforts in globalization.

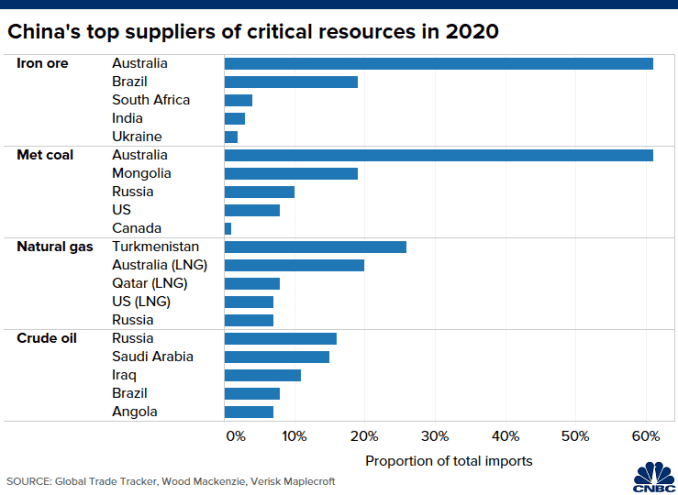

This era of intensified international geopolitics is not an era of reasoning and logic, while politicized competition more often than not is the most common means of communication. Interestingly, while the Western part of the world, which is headed by the United States are stepping up "technology weaponization" against China, they are also accusing China of "market weaponization", that is, using market space as a "weapon" against trading partners of different political views by implementing "coercion" and suppression. The friction between China and Australia in trade and geopolitics in the past two years has been regarded as an example of this by Western countries. Refinitiv's data shows that in 2020, Australia shipped 60.86 million tons of iron ore to China every month, accounting for more than 60% of China's overall imports of this product. Research firm Capital Economics stated that China is Australia's largest trading partner in goods and services so far, accounting for 39.4% of goods exports and 17.6% of services exports from 2019 to 2020.

The latest report by Verisk Maplecroft, a risk consulting firm, shows that China is diversifying its supply of key natural resources. This move will support China's ability to use trade weapons against geopolitical opponents. The report believes that if China were to have a weakness, it would be its high dependence on foreign natural resources. China is a major consumer of major commodities including crude oil and iron ore, and it relies heavily on imports to meet domestic demand for these commodities. Verisk Maplecroft said that one way for China to diversify its sources of imports is to buy shares in overseas companies, which will increase the proportion of Chinese resources in the country's total imports. To cite an example, the number of Chinese-funded base metal and gold companies in Oceania increased from zero in 2000 to 59 last year. The report shows that it accounts for approximately 22.6% of the total foreign ownership of such companies. From the perspective of foreign capital, China is seeking to strengthen its control over the global supply chain through overseas investment and cooperation with large international companies. One of the purposes of Chinese state-owned enterprises to "go global" is to establish control over overseas resource bases.

Source: CNBC

Obviously, in the view of foreign institutions, China's huge market space needs a stable energy and resource supply, which forms a two-way "resource-market" dependence, that is on the one hand, it is a weakness that takes the form of China's dependence on external resources, and on the other hand, it also causes dependence of resource supplier countries on the Chinese market. Some foreign institutions believe that China used to import key commodities such as crude oil, natural gas, metallurgical coal and iron ore from "highly concentrated" trading partner groups, but now it is striving to diversify its sources of imports. The West generally perceives China as being more inclined to choose countries with "stable authoritarian regime" as its resource suppliers, rather than democratic countries that may involve frequent changes in government or potential changes in policies. From the perspective of foreign capital, China uses market space "weapons" and promotes supply diversification, and will be more than capable of fighting a "trade war + geopolitical war" with its geopolitical opponents. Some external studies believe that China's ban on coal imports from Australia is a typical example, and China will also accelerate its reduction of dependence on "unfriendly" resource suppliers, an act that will continue geopolitical tensions.

The two viewpoints and policy practices of "technology weaponization" and "market weaponization" show that the differences between China and the United States as well as other countries are constantly deepening. Whether it is by using technological superiority or market space as a "weapon", the reason behind all of this is the basis for the deterioration of geopolitical relations. The deadlock in geopolitical relations between the United States, China, and other countries cannot be reversed in a short period of time. Some researchers at ANBOUND estimate that such pattern of opposition may last for 10 years, if not longer. In this situation, "technology weaponization" and "market weaponization" will continue for a long time, and will develop to be more detailed, dense, and maneuverable. This period coincides with China's 2035 long-term planning period. As such, China's economic and geopolitical security will have no alternative but to accept such long-term challenges.

Final analysis conclusion:

The West's "technology weaponization" against China, and China's "market weaponization" against the West will exist for a long time to come, constituting the basic pattern of China's future development. Simultaneously however, China still needs to persist in its efforts at globalization, keeping the market open, and establish a better open economic system.