The establishment of a green financial system in China is being stepped up with the introduction of the "3060" carbon peak and carbon neutral targets last year, in which China pledges to aim for peak emissions in about 2030, and reach carbon neutrality before 2060. The establishment of a national carbon emission trading market is an important measure to control greenhouse gas emissions and promote green and low-carbon development by utilizing market mechanism. It is also one of the core policies to achieve the "3060" targets. Recently, the Chinese Ministry of Ecology and Environment has released the revised draft of the Interim Regulations on the Management of Carbon Emission Trading and is soliciting opinions from the public, which means the implementation of a nationwide carbon emission trading market in China is not far off. In fact, this is a starting point for the development of green economy and green finance in China, and there is enough room for the green finance and green economic system in the future. As ANBOUND has noted, this also provides new market space for structural reform and sustainable development of China's economy. However, a green financial development system based on the carbon trading market is not a one-step process, and there is still a long way to go for shaping mechanisms and institutions in the future.

Since December last year, the Ministry of Ecology and Environment has issued a series of documents, including the National Measures for the Administration of Carbon Emission Trading, quota scheme, the list of key emitters, etc. On February 1 this year, the Administrative Measures for Trading of Carbon Emission Rights formally came into effect. The Interim Regulations on the Management of Carbon Emission Trading is also a further implementation of the carbon trading system by the regulatory authorities with the Ministry of Ecology and Environment as the main body, which provides an institutional and legal basis for the establishment of a national carbon trading market. Officials from the Ministry of Ecology and Environment, as well as carbon exchanges, have stated that a national carbon trading market will be opened in the first half of the year.

In fact, carbon trading is a market-based trading system with carbon emission rights (quotas) as the medium, which is similar to financial product trading in the financial market. The seller can sell its excess carbon emission rights, while the buyer can obtain the emission rights by paying the seller. This mechanism will help to achieve the obligation and target of greenhouse gas emission reduction, and also realize the effective transfer of carbon emission rights within the system. At the same time, its significance is to set a price for greenhouse gas emissions and gradually realize emission compensation, so as to encourage enterprises and other market participants to actively participate in the development of emission reduction and carbon reduction. Therefore, the establishment of a carbon trading market is actually the basis for green development.

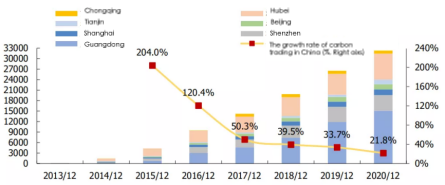

In terms of current trading volume, data show that as of November 2020, the cumulative trading volume of the pilot carbon markets was nearly RMB 10 billion, or equivalent to 430 million tons of carbon emissions. According to a preliminary analysis by the National Development and Reform Commission (NDRC), future carbon emissions could reach 3 billion to 4 billion tons a year if measured by the carbon emissions of the eight major industries. Excluding futures trading, the volume of spot trading would be expected to reach RMB 1.2 billion to RMB 8 billion a year. If futures trading is taken into account, the volume of carbon trading could reach RMB 60 billion to RMB 500 billion. The People's Bank of China also indicated that carbon financial products such as carbon futures, carbon options, carbon forwards, carbon funds, and carbon indices will usher in a new stage of innovation with the nationwide promotion of carbon trading.

Figure: Cumulative trading volume and growth rate of carbon trading in China and pilot provinces and cities (unit: 10,000 tons, %)

Source: Wind, Guosheng Securities

In terms of scope, the first step is to include coal power companies with large carbon emissions. Starting from January 1, 2021, China's carbon trading market started its first compliance cycle, the first of which will run until December 31, involving 2,225 key emitters in the power generation sector. Industries such as steel, construction, and transportation will be gradually included in the future. Some institutions estimate that there will be about 8,000 to 10,000 emission control enterprises in the eight major industries. With the introduction of financial institutions and investors, carbon trading market may become the largest trading market of economic activities.

From the content of the Interim Regulations, only general and principled provisions have been put forward on the allocation and verification of carbon emission quotas, which are of great concern at present, and further details are still needed for future implementation. For the current carbon emission quota, the Interim Regulations stated that the initial allocation will be free of charge, and the paid allocation will be introduced in time according to national requirements, and the proportion of paid allocation will be gradually expanded. Some analysts believe that before the carbon peak, free allocation may be adopted and the coverage of carbon trading will be gradually promoted; after the carbon peak, paid allocation will be promoted to strengthen the driving force of the market, so as to achieve the goal of "carbon neutrality". From the international perspective, this means that the price of emission quotas will gradually rise with the limited quotas and the increase of participants. Therefore, quota allocation and carbon emission verification will be the key in the development of a green financial system, which not only plays a guiding and restraining role in the future development of enterprises and industrial development, but also affects regional economic development.

As for a multi-level carbon trading market comes into being, the Interim Regulations make it clear that no regional carbon trading market will be set up after the establishment of a national carbon market, and existing pilot projects will be retained. Enterprises not included in the national carbon market can continue to participate in the regional carbon market and conduct carbon management through marketization. This indicates that a multi-level market system, mainly the national market, will constitute the pattern of China's carbon trading market. During this period, the connectivity, competition, and balance among the markets are also major challenges for the formation of the green market.

Different from stock, bond, and other securities trading, carbon trading involves multiple aspects such as the declaration of initial carbon emission rights, allocation of quotas, verification, as well as trading and compliance clearing. In addition, carbon trading currently covers high-carbon emission sectors such as coal, electricity, and steel. In theory, it would cover all industries and enterprises in economic activities, and involve a larger number of enterprises than the current financial market. Therefore, compared with the more mature financial securities markets such as stocks and bonds at present, the carbon trading system will be more complex, involving the overall industrial layout and all economic activities. This system will be an extremely important part of the future economic system, involving major aspects of economic and social life.

Final analysis conclusion:

Compared with the development process of the capital market, the carbon trading market faces more complex mechanism, wider coverage, higher technical requirements, and stricter transparency requirements. This means that the carbon trading market has stronger systematic requirements and greater difficulty. Shaping the whole market mechanism and system will be a long-term process of revision and improvement. Hence, policymakers and market participants need to be aware of this.