While the COVID-19 pandemic continues to impact the global economy, the European economy showed a relatively strong recovery in the second quarter with the intensification of vaccine rollout and the continuation of the European Central Bank stimulus policy. In this period, the gross domestic product (GDP) of the Eurozone increased by 2% month-on-month and 13.7% year-on-year, while the GDP of the European Union increased by 1.9% month-on-month and 13.2% year-on-year. The European Central Bank expects the Eurozone economy to rebound sharply in 2021. The European Commission has also raised its expectations for full-year economic growth. Its expectations are the growth rates of the EU and Eurozone economies will reach 4.8% and 4.5% in 2021 and 2022 respectively, higher than the previous forecast of 4.2% and 4.4%.

However, unlike previous optimistic expectations, recent data shows that a larger number of institutions are worried about the prospect of a sustained rebound in the European economy. Although the recently released August IHS Markit Eurozone PMI data maintains a relatively high value, compared with the previous month, there are varying degrees of decline, and the data is generally lower than expected. The initial value of the manufacturing PMI of the Eurozone in August was 61.5, and the expected value was 62, the previous value was 62.8; the initial value of the service industry PMI in August was 59.7, the expected value is 59.5, while the previous value was 59.8. The manufacturing and service industry PMIs of Germany and France were lower than the previous month's level, while the initial value of the German manufacturing PMI was at a six-month low. The fall of this leading indicator is a likely indication that the expansion of the European economy will slow down. Not only is the growth of the service industry facing the threat of a resurgence of the COVID-19 outbreak, manufacturing powerhouses such as Germany will also face the bottleneck of recovery with an increase in the global supply chain distortions. Institutions like Goldman Sachs even believe that the peak of European economic growth has passed and is currently entering an inflection point. It is also expected that the economic growth rate of the Eurozone will continue to slow down in the next few months.

According to Goldman Sachs, the European economy will likely see a slow return to its pre-pandemic level. In fact, the liquidity indicators of the Eurozone countries have returned to that level. That said, the scale of nominal GDP has not returned to the pre-2019 level or even the level of the 2008 financial crisis. The current accelerated growth of the monetary supply of the euro is the main factor pushing up GDP. Looking at the longer cycle, the European economy, particularly that of the Eurozone will return to a long-term path of low growth. However, in comparison to the pre-pandemic era, problems such as the deteriorating fiscal situation and the uneven economic development of industries and regions that have plagued the Eurozone will further worsen. It will have a more serious impact on production, investment, and employment in the EU.

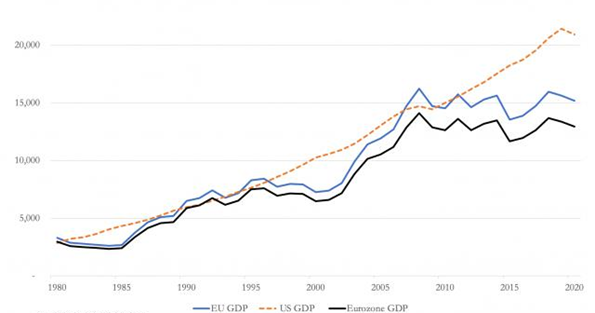

Although the European Central Bank has adopted easing policies and even negative interest rate policies for a long time since the 2008 financial crisis, the EU economy has remained stagnant relative to the United States. It can be seen that the ageing problem, regional disparities, and debt burdens affecting the EU economy will still be issues of concern to the Europeans in the post-pandemic time. On the one hand, after the European sovereign debt crisis, the gap in GDP growth between the euro area and non-Eurozone member states has increased from 9% of total GDP to 15% since 1994. On the other hand, at the end of 2020, the government debt of Eurozone member states has risen to 98% of GDP. The Eurozone's government deficit has continued until this year, and the European Central Bank (ECB) expects the deficit to rise to 8.7% of GDP in 2021. The accumulation of these long-term factors has even surpassed the 2008 financial crisis, posing a great hidden danger to the future of the EU economy, bringing greater challenges to the European Central Bank's monetary policy.

Chart: Comparison of the GDP scale of the European Union, the Eurozone, and the United States (unit: billion U.S. dollars)

Source: World Bank, Goldmoney

Under the current circumstances, the European Central Bank stated that its continuing monetary easing to consolidate economic recovery. However, it still faces two challenges. One is the threat of inflation in the European Union; the other is the impact of future changes in the Federal Reserve's policy. Eurozone inflation reached 2.2% in July, up from 1.9% in June and 2% higher than expected. This is also the first time the Eurozone's CPI exceeds the 2% target set by the European Central Bank in the past three years, setting a new high since October 2018. In July, the core inflation rate excluding energy, food, tobacco and alcohol prices was 0.7%. In August, the German CPI reached 3.4% year-on-year, which was higher than the 3.1% in July. The Eurozone Harmonized CPI (HCPI) is expected to be 2.7% in August and 2.2% before. If the actual value is in line with expectations, it will hit a new high never seen since 2013. Although the European Central Bank still insists on the short-term nature of inflation, it was already a threat to the euro. In the case of slowing economic growth, it is difficult for the European Central Bank to expand easing to stimulate the economy.

As the European Union's economic recovery is significantly slower than the United States, the European Central Bank's adherence to the current easing policy will distance itself from the Fed's possible policy shift to reduce easing at the end of the year. Following the Fed's tightening the easing policies, the Eurozone will face changes in interest rates as a result of policy differences. This could have a negative impact on the EU's economic recovery. The impact of inflation and interest rate changes will be extremely challenging for the Eurozone and the European Union. The debt burden of some EU countries that have experienced crises has further increased. The current debt-to-GDP ratio of Greece is 217%, Italy is 151%, and Portugal is 137%. In the case of a long-term economic downturn, the problem caused by inflation may become more serious, which will not only further worsen its fiscal imbalance but also cause banking institutions and financial systems to face difficulties. Therefore, of great concern is whether the European Central Bank can safely withdraw from the stimulus in the future and realize the normalization of monetary policy.

Final analysis conclusion:

The long-term problems of the Eurozone's economy and financial system will further accumulate in the post-pandemic period, which creates more daunting challenges to the European Central Bank's monetary policy.