The global semiconductor industry has witnessed great growth in the past two years amid the impact of COVID-19 and geopolitics. The global economy is estimated to have contracted by 3.5% in 2020, but the semiconductor market bucked the trend that year. According to World Semiconductor Trade Statistics (WSTS), an authoritative semiconductor research institute, the worldwide semiconductor market sales were USD 440.389 billion in 2020, an increase of 6.8% from 2019.

ANBOUND's tracking research shows that the global semiconductor market is expanding against the trend due to several factors:

First, it is related to changes in supply and demand in the semiconductor market. The spread of COVID-19 across the world has greatly hindered economic activities and people's gathering, stimulated the demand for remote work and online services, and increased the market demand for electronic products such as smartphones and tablets, thus increasing the demand for chips, driving the development of the global semiconductor industry.

Second, the continued spread of COVID-19 and increased geopolitical frictions have exacerbated fears of chip shortages among global manufacturers. As a large number of manufacturers from automobile manufacturers, computer manufacturers, mobile phone manufacturers, to AI application manufacturers, all fear of chip outages. This caused then to place multiple orders and stockpile chips in large quantities, raising the demand for chips in the short term.

Third, it is related to changes in industrial and supply chains under special circumstances. The semiconductor is a typical global industry, and its industrial chain extends very widely, involving many industrial links such as materials, equipment, software, spare parts, etc. Changes in one of the above links will affect the entire semiconductor industry chain. The semiconductor industry is highly globalized. According to the U.S. White House supply chain assessment report, the semiconductor production process involves many countries and regions, and the typical process takes more than 100 days, with the underlying semiconductors crossing international borders 70 times, about 12 days of which are transit between supply chain steps. Once the supply chain is disrupted, the semiconductor industry will be severely affected. The outbreak and geopolitical friction in the past two years have hit the semiconductor industry chain and supply chain.

Fourth, it is related to the global political climate. Geopolitical factors have caused a special impact on the semiconductor industry, especially the friction between China and the United States, which has artificially raised the strategic value of the semiconductor industry, making the semiconductor industry a strategic industry and semiconductor chips a strategic material. Non-market political factors have hampered the supply system in the past, increased uncertainty in the industry, and exacerbated supply constraints in the semiconductor industry.

Fifth, the information-orientation and intelligentization of many industries have boosted the demand for semiconductor chips. Industries such as artificial intelligence (AI), smartphones, tablets, automotive electronics, the Internet of Things, smart cities, intelligent production, telecommuting, and online education services are stimulating demand for semiconductors. Even after the pandemic is brought under control, some of these demands will not return to pre-pandemic levels, but will become a regular demand.

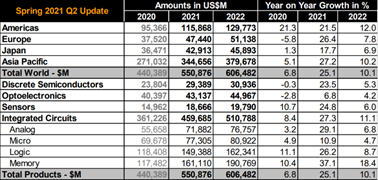

Figure: World Semiconductor Trade Statistics (WSTS) Q2 2021 forecast

Source: World Semiconductor Trade Statistics (WSTS)

These changes have prolonged the semiconductor industry cycle in the past and completely reversed the era of "cheap" chips. The industry expects that this round of semiconductor industry expansion will continue for another 1-3 years, forming a semiconductor "supercycle", and its market size is expected to reach the average forecast of USD 570 billion in 2022. According to the forecast of WSTS, the global semiconductor market size will reach USD 550.876 billion in 2021, with a year-on-year increase of 25.1%, and USD 606.482 billion in 2022, with an increase of 10.1%.

Any cycle has its ups and downs. How long will this semiconductor "supercycle" last? When will it slow down? The related judgment will affect the industry investment and capital investment.

Some industry insiders expect that this round of "supercycle", stimulated by a variety of factors, may end in 2 or 3 years. The main reasons are as follows:

First, incremental investment on the supply side will help achieve a new supply-demand balance. In the past two years, more and more enterprises, such as TSMC, Intel, Samsung, SMIC, etc., have announced plans to build new plants, which are expected to be completed successively in recent years, forming the incremental supply capacity of semiconductors. Second, as the pandemic situation improves, the previously explosive demand growth will slow down or even decline. In fact, the demand growth of some semiconductor components in 2021 has already fallen to single-digit growth, and will continue to slow down in 2022. Third, as the pandemic is brought under control, the global supply chain will gradually establish a new balance, significantly easing market concerns about supply chains and industrial chains, and reducing the explosive demand caused by stockpiling and multiple orders.

ANBOUND's researchers would also like to point out that shortages and price rises at the supply side of the global industrial chain, which are becoming increasingly common, are related to the basic situation of excess capital. As excess capital amplifies the demand side and makes the supply side have a bigger say in the market, this situation may stimulate more industrial investors to take advantage of the supply-side price hikes. ANBOUND noted in its tracking research that some semiconductor chip makers have started to push for price increases, citing rising raw material costs and longer production cycles. For example, several chipmakers, including NXP, Renesas Electronics, and Toshiba, have raised prices for auto chips. ANBOUND's recent research in China also shows that the increase in chip demand has driven the upstream of chip production, such as silicon wafers, ultra-pure silicon raw materials, and other upstream materials industry, which has also seen very good times in the past two years, with products in short supply.

Final Analysis Conclusion:

Overall, the spread of COVID-19 and geopolitical factors, while depressing the economy, stimulated the growth of the semiconductor industry, creating a "supercycle" by prolongating the boom period. For now, this semiconductor "supercycle" is likely to last one to three years, peaking around 2023, after which industrial growth is likely to slow. However, due to the increase in demand in this cycle has enough support, even if the pandemic is over, the new demand may become a stable demand in the future, so that the semiconductor market will maintain a considerable level of market size while the growth rate slows down.