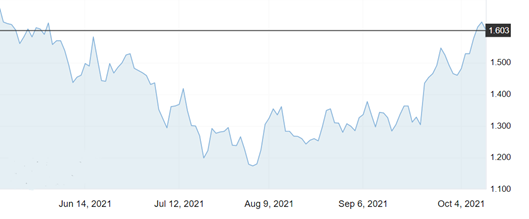

Since the beginning of October, market expectations for U.S. inflation and the Federal Reserve’s tapering have risen again amid rising international energy prices. After the international crude oil prices topped USD 80 a barrel, the 10-year Treasury yield rose above 1.6% level in October, and the structural inflation expectation rose rapidly again to the level near the peak in March, showing the rise in market concerns about inflation and even stagflation in the context of the energy crisis. There has also been a marked change in the Fed's recent stance on inflation. Fed Chair Jerome Powell also acknowledged that the impact of inflation has been greater and longer-lasting than expected. For the United States, changes in inflation are having an increasing impact on its economy and policy. However, ANBOUND believes that while rising inflation has become a global trend, the evolution of its structural contradictions could actually be a bigger problem going forward.

Figure 1: U.S. 10-Year Treasury Yield (%)

Source:Investing.com

In the case of the U.S., this year's trend of high inflation will gradually become accepted as a reality. Not only are energy prices rising, but prices of goods and services such as food, consumer goods, rent, and transportation are also rising. At the same time, the distortion of the global supply chain and the high transportation costs have brought more and more serious troubles, resulting in an imbalance between supply and demand that is difficult to restore in the short term. The question now is how long will the high inflation trend last? At this point, it is not clear whether this inflationary trend will be a "short-term inflation" as the Fed insists, or a more worrying stagflation.

In any case, as far as monetary policy is concerned, there is a growing consensus that a Fed tapering in November is a foregone conclusion. More worrying, however, is that the structural problems reflected by inflation are not something that the Fed's monetary policy can solve. Those who hold the view of "short-term inflation" tend to hold a holistic view of the high inflation, believing that the cause is the slow recovery of production, which is not able to meet the retaliatory rebound in demand in the post-pandemic period. As demand growth slows and production recovers, the balance between supply and demand will be restored.

In terms of energy issues, short-term increases in energy prices could push up inflation in the coming months, curb consumer spending on other goods and services and cause a slowdown in the U.S. economic recovery. However, the U.S., which has become a major energy supplier, may not be severely affected compared to major energy importers such as Europe and Asia. From a short-term perspective, the energy problem stems mainly from the imbalance between supply and demand, and with the release of supply-side capacity, a new balance should soon be achieved.

However, based on current employment, inflation, and U.S. economic data, researchers at ANBOUND had pointed out that the situation of employment and inflation under the impact of COVID-19 is more structural in nature, reflecting that there are also structural problems in the U.S. economy. Some market analyses likewise argued that temporary factors could fully explain the bottlenecks in supply chains, shipping, and labor in the first half of this year. But the reality is that, far from easing, the supply bottleneck has worsened in terms of both depth and breadth after half a year. This also raises deeper questions on the supply side.

From the perspective of the supply side, the constraints on demand mainly come from the following aspects: 1. global shipping capacity is strained; 2. electricity and energy supply shortages; 3. labor shortage.

Especially from the perspective of the labor market, the labor force participation rate in the U.S. has declined rather than risen, making it difficult for the employment situation to reach the Fed's target. Some of these supply-side factors are caused by short-term factors, some by changes in the geopolitical environment, and some by structural changes brought about by the pandemic. Factors such as increased policy constraints on climate change, the rise of telecommuting or online learning, as well as increased trade barriers and restructuring of global industrial chains in the face of geopolitical conflict are all increasingly long-term in nature.

As far as the demand side is concerned, the release of overall demand is not only reflected in electronic products, housing, and ordinary consumer goods during the epidemic period, but also gradually reflected in the service sector. However, there are also analyses that the most easily recoverable part of the U.S. service consumption has passed, and the remaining recovery space comes from the categories related to pandemic exposure and offline office work, which will still be relatively slow to recover. This will not only slow down the overall economic recovery, but will also eventually affect the price level. As a result, hyperinflation remains unlikely in the face of a less resilient recovery in aggregate demand. The long-term problem, however, is that increased capital spending to address the current shortage may turn into excess capacity after a period of time, thus increasing long-term deflationary pressure, while capital market investors are reluctant to expand investment in the face of uncertain prospects due to corporate profitability and return on investment, which also makes real investment demand facing uncertainty.

This complex reality and long-term perspective make the Fed's policy choices more difficult, and the effect of further easing or tightening is compromised by structural contradictions. A survey by Deutsche Bank suggests there is growing concern that major central banks such as the Federal Reserve, European Central Bank, and Bank of England could make a policy mistake by being too dovish or hawkish. In the view of ANBOUND, central banks are also facing increasing dilemmas and difficulties in promoting economic recovery with monetary policy, and the space for monetary policy is becoming increasingly limited. At the same time, the responsibility of the U.S. to restructure the economy by expanding infrastructure investment and promoting distributive balance through fiscal stimulus becomes more important and urgent.

Final analysis conclusion:

The energy crisis has made it all but a fact that U.S. inflation remains high. But as far as its prospects are concerned, inflation in the United States is showing more and more structural contradictions and will be a major factor hindering economic recovery and growth in the country.