Under the impact of the Covid-19 outbreak, international oil prices have seen a rare plunge. In the early morning of April 21 (Beijing time) WTI crude for May delivery plunged more than 300%. It was traded below negative USD 40/bbl (barrel) and settled at negative USD 37.63/bbl, which closed negative for the first time in history. That means producers and oil traders in the U.S. market were willing to pay nearly USD 40/bbl for someone who willing to buy crude oil from them.

It should be pointed out that the "negative oil price" in the early morning of April 21 is the phenomenon that appears in a specific region (North America), at a specific time (delivery in May). At the time when WTI oil price hit new lows, Brent crude for June delivery remained above USD 25/bbl while WTI crude for June delivery remained at the "normal level" of $20/bbl. However, ANBOUND's macro research team said in the discussion at noon on April 21 that the "normal" oil prices may not hold out much longer, a simple inference is: If the pandemic situation continues to be severe in the June crude oil delivery period, and there is still no significant positive news in the oil market on inventories, production cuts, and demand, then the price of crude oil for June delivery is likely to fall sharply.

Meanwhile, on the afternoon of April 21 (Beijing time), the international oil price collapsed. Brent crude for June delivery plunged to USD 18.1/bbl; WTI crude for May delivery, which had returned to positive levels on the morning of 21st, fell to negative USD 10/bbl again, and WTI crude for June delivery fell below USD 12/bbl.

Figure 1: U.S. WTI futures prices over the past six months

Source:CNBC

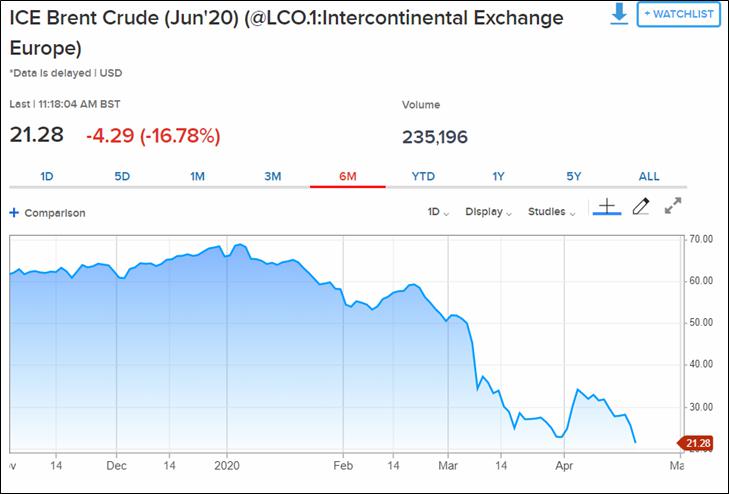

Figure 2: Brent crude futures prices over the past six months

Source:CNBC

Although the negative oil price in the international oil market is only a very rare situation, and there are technical factors (such as the need for delivery and rollover), but it is mainly determined by economic fundamentals. Under the pandemic situation, the collapse of oil prices exposed that the global economy, the international oil market, and the oil industry are facing a serious crisis, especially the oil industry will suffer serious structural impact. On the macro level, the reason for the recent oil price decline is not complicated, it is mainly due to the imbalance between supply and demand. The global spread of the disease caused the global economy to "freeze" and global oil demand to collapse. At the peak of the outbreak in February, China's oil demand alone fell by more than 3 million barrels a day. According to forecasts by the International Energy Agency (IEA) and some investment institutions, global oil demand will plunge by a quarter to a third in 2020 from 2019, with the size of a 25-35 million bpd (barrels per day) decline due to the outbreak. That is almost as much as OPEC's total output or North America's total oil consumption. Against this macro backdrop, the OPEC+ agreement to cut output by 9.7 million bpd is basically unable to help in anything.

The short-term trigger for a collapse in the oil price is straightforward - the world has nowhere to store the oil it produces. With global energy demand plummeting, the world's refineries are now reluctant to refine oil into gasoline, diesel, and other products. Meanwhile, oil production continues, leading to a rapid depletion of the world's oil storage capacity. Some energy experts estimate the world's oil storage capacity at 6.8 billion barrels, of which nearly 60% has been used up. At the moment, one of the best businesses in the oil chain industry is oil storage, much of which is stored on tankers and barges. Owning storage tanks has become an advantage in the oil industry.

The United States has 635 million barrels of strategic oil reserves and could store another 75 million barrels. However, this is only equivalent to 6 days of its oil production (nearly 13m bpd from the end of last year to the beginning of the year). In the Caribbean and South Africa, oil warehouses are almost completely depleted; In Angola, Nigeria, and Brazil, oil storage capacity could run out within days. The depletion of oil storage capacity is a constraint on the global oil industry and has hit the oil futures market.

The situation in the global oil market is dire. In the future, there are three issues that deserve special attention. First, the future impact and development trend of the global oil industry. Second, the future trend and changes in the international oil market. Third, the interaction between the impact on the global oil market and the global economy.

First, the global oil industry will face multiple risks ahead. (1) Under the continuous impact of the pandemic, the upstream oil exploration and production losses are serious. In a fully market-oriented world, oil companies have the freedom to reduce their production, but China's oil majors also need to take into account the political factor, i.e. keep jobs and maintain its operations. It is understood that the major domestic oil companies have been producing at a loss, and it is better off to buy oil than to produce oil. Producing at a loss is mainly to ensure the employment and the survival of workers. Against this backdrop, capital expenditure in the global oil industry will be sharply reduced. (2) The impact of the crisis is reflected in the whole industrial chain. The midstream refining sector is also struggling. Although the cost of crude oil is cheaper, the sales of refined oil have fallen sharply due to the shrinking demand, which will force to squeeze refining sector profits. Domestic refined oil products have a floor price (USD 40/bbl) mechanism, which can protect part of the profits of oil companies, Whereas, it still cannot make up for the loss. (3) Oil transportation, trade, oil service, and other fields will also be impacted. Some highly indebted enterprises will encounter liquidity crises and debt crises, and more and more oil enterprises will face bankruptcy.

Second, the international oil market will remain depressed for a long time and it is difficult for the international oil price to recover significantly in the short term. Anyone who thinks oil prices have fallen to floor prices is playing with fire because they could fall even lower, according to a market analysis cited by CNBC. If the pandemic and the recession persist, a negative oil price shock similar to that of a WTI crude for May delivery will recur, and so will the trend for June and July delivery. Once the oil price trend becomes the market consensus, it will have a bigger impact on oil futures investors. At that point, investors are likely to be overwhelmingly bearish on oil prices for at least some time. That will certainly not conducive to the recovery of the oil market.

Third, the turmoil in the oil market and the oil industry will interact with the economic crisis under the impact of the pandemic, forming a superposition effect and exacerbating the lethality of the global economic depression. The sharp drop in oil prices is the result of the economic crisis, which in turn will aggravate the depth and damage of the global economic crisis and the "internal problem" of the economy and industry under the depression. At present, the pandemic has impacted the oil industry through a variety of chains, such as: "travel restrictions - aviation bans - reduced fuel demand - impact on the oil industry". Another possible chain is "aviation bans - stop buying aircraft - impact on aircraft manufacturing - damage to the aviation manufacturing chain - reduced industrial demand for energy – impact on oil prices".

In the future, the duration of the outbreak is key to the outlook for oil prices and the oil industry. If the outbreak lasts for a long time and the world continues to lockdown, shut down services and cut consumption, energy demand will remain depressed for a long time, which will have a devastating impact on the oil industry. If the economic cost of the outbreak exceeds that of a world war, it will be too much for many countries to bear, and people in some countries may face a choice between dying of illness or starvation. We believe that if the outbreak persists, it is likely that some countries, particularly developed countries, will "forcibly" resume work in order to restore their economies as soon as possible. Otherwise, similar shocks to the oil industry will occur in other industries, many of which will face collapse.

Final analysis conclusion:

The international oil market has become a window into the impact of the Covid-19 outbreak, and the world is facing an economic depression of uncertain duration. In this crisis, many deep structural adjustments at the industrial level will occur, even resulting in the paralysis of the entire industrial chain, which will have a huge impact on the global economy.