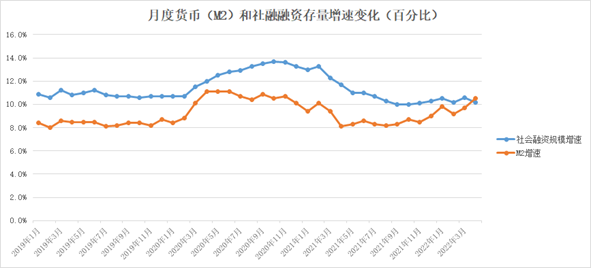

The latest financial data from the People's Bank of China (PBoC) showed that at the end of April, the M2 balance was RMB 249.97 trillion, up 10.5% year on year, 0.8 percentage points higher than the end of last month, and 2.4 percentage points higher than the same period last year. The balance of narrow money (M1) was RMB 63.61 trillion, up 5.1% year on year, 0.4 percentage points higher than the end of last month, and 1.1 percentage points lower than the same period last year. The balance of currency in circulation (M0) was RMB 9.56 trillion, up 11.4% year on year. The net cash injection for the month was RMB 48.5 billion. In terms of monetary data, the growth rate of M2 remained high and basically achieved the target of "matching nominal GDP growth", but the slowdown in M1 growth indicated a significant decline in economic activity in April. With the PBoC pushing for a reserve requirement ratio (RRR) cut, researchers at ANBOUND believe that changes in monetary data suggest that the impact of the COVID-19 pandemic on the economy is currently the main obstacle to the transmission from "monetary easing" to "credit easing". If this situation persists, monetary policy will lose its role in influencing the economy and the authority will need to reformulate their macro policies to achieve the goal of "stable growth".

Monthly change in the growth rate of M2 money supply and total social financing (percentage)

Source: People's Bank of China.

Statistics in April showed robust financial support for the real economy, the PBoC said. At the end of April, the growth rate of broad money supply (M2) and total social financing was 10.5% and 10.2% respectively, both at a relatively high level of over 10%. New loans in the first four months amounted to RMB 8.9 trillion, the second-highest level on record for the same period. However, these changes mainly reflect the effect of the PBoC's easing policy in the first quarter, which still has a certain inertia. According to the calculation of ANBOUND, there was a significant decline in the M2 increment in April. The M2 increment in April was only RMB 200 billion, while the M1 increment was negative. Apart from seasonal factors, these changes indicate that financial activities in April showed a significant decline. At the end of April, outstanding loans in local and foreign currencies totaled RMB 207.75 trillion, up 10.6% year on year. Outstanding RMB loans at the end of the month were RMB 201.66 trillion, up 10.9% year on year, 0.5 percentage points lower than the end of last month, and 1.4 percentage points lower than the same period last year. In terms of incremental growth, new RMB loans increased by RMB 645.4 billion in April, RMB 823.1 billion less than the increment same period last year; that was about RMB 2.48 trillion less than the RMB 3.13 trillion in new RMB loans issued in March. In terms of the credit structure, household loans decreased by RMB 217 billion, which was RMB 745.3 billion less than the increment same period last year. Among them, housing loans decreased by RMB 60.5 billion, RMB 402.2 billion less than the increment same period last year; consumer loans excluding housing loans fell by RMB 104.4 billion, RMB 186.1 billion less than the increment same period last year; business loans decreased by RMB 52.1 billion, RMB 156.9 billion less than the increment same period last year. Enterprise (Public Institution) loans increased by RMB 578.4 billion, RMB 176.8 billion less than the increment same period last year, of which short-term loans decreased by RMB 194.8 billion, medium- and long-term loans increased by RMB 265.2 billion, and note financing increased by RMB 514.8 billion. Loans from non-banking financial institutions increased by RMB 137.9 billion.

Researchers at ANBOUND believe that there are two main factors for the decline in April's credit scale. One is that loans for house purchases declined greatly amid the downward trend of the real estate market. Second, due to the pandemic factors and the prevention and control measures in some regions, not only the housing consumer loans declined significantly, the increment of operating loans also saw reduction, while more enterprises relied on note financing and non-bank loans. This shows a prominent contraction of money-to-credit transmission through credit expansion. The PBoC also said in its interpretation of the data that the growth of RMB loans slowed significantly in April, reflecting the impact of the recent pandemic on the real economy. Combined with factors such as shortages of factors of production and rising costs of raw materials, various enterprises (especially micro, small and medium-sized enterprises) are facing more difficulties and their demand for effective financing has critically decreased.

The amount of total social financing in April also reflected a sharp decline in incremental financing. At the end of April 2022, the stock of social financing amounted to RMB 326.46 trillion, up 10.2% year on year, with a decline in growth rate compared to 10.60% at the end of March. In April, social financing increased by RMB 910.2 billion, down by RMB 3.7429 trillion from RMB 4.6531 trillion in March; it was RMB 946.8 billion less than the same period last year. In terms of year on year, only government bond financing and corporate equity financing increment increased in April, while the increment of other financings all declined to varying degrees. In particular, RMB loans to the real economy increased by RMB 361.6 billion, RMB 922.4 billion less than the increment same period last year, which was the main factor behind the sharp drop in the increment of social financing.

On the whole, financial data in April showed a sluggish sign, mainly due to the obvious decline in credit data, which not only reflects the contraction of the real estate market, but also reflects the overall weakening of financial demand in various areas such as consumption and investment. Especially when the PBoC continues to promote the "moderately easing" policy, the transmission mechanism of financial supply from "monetary easing" to "credit easing" has been tellingly inhibited. In the view of ANBOUND, such restraint actually comes from the credit contraction caused by the suppression of economic activities due to the continuation of the pandemic and prevention and control policies. The pandemic-related factors are causing great disruptions to the industrial chain and logistics system, as well as limiting the movement of people and economic activities in some areas, which are leading to a significant contraction of demand in the overall economy. As the pandemic situation persists, such contraction is not something that monetary policy can mitigate or meliorate. In the case of uncertain future expectations of enterprises and households, it is difficult for aggregate easing and incremental structural policies to play a role in credit expansion.

What is more worrying is that the situation in May is equally bleak. The pandemic situation is not only continuing in the Yangtze River Delta and Pearl River Delta, but the Beijing-Tianjin-Hebei region is also experiencing a wider range of lockdowns. In this case, it is difficult for the financial environment to stimulate and restore economic activities, which also makes the overall economic growth in the second quarter declined sharply, resulting in a "hard landing". Researchers at ANBOUND believe that the key to solving the current economic issues is to adopt flexible pandemic prevention and control measures, establish a new balance between pandemic measures and economic growth, and avoid economic collapse due to the continuous contraction of overall credit demand and overall demand caused by the COVID-19 outbreaks. This is also a prerequisite for monetary or fiscal policy to work in the future.

Final analysis conclusion:

In April, both the increment of money supply and social financing contracted significantly in China. This indicates that under the impact of the COVID-19 pandemic, the transmission of monetary easing to credit easing was significantly inhibited. It also appears that pandemic-related factors, as well as corresponding measures were the main reasons for the contraction of credit. The balance between pandemic measures and economic growth needs to be further adjusted, so as to achieve stable growth and avoid an economic stall. This, in turn, is the prerequisite for macro policy effects to be brought into play.