China's National Bureau of Statistics (NBS) has recently released data indicating that the country's manufacturing sector remains in a state of expansion, with a PMI reading of 51.9% for March. Meanwhile, the non-manufacturing sector's business activity index surged to 58.2%, reflecting the increasing momentum of the country's recovery. The comprehensive PMI output index rose to 57.0%, up 0.6 percentage points from the previous month, which suggests that Chinese enterprises' production and operation have improved overall. However, the manufacturing and non-manufacturing PMI indexes are diverging, with the manufacturing sector showing signs of decline, while the non-manufacturing sector continues to grow. These findings align with ANBOUND's earlier prediction of a gradual economic recovery rather than a sudden rebound. Nevertheless, the latest PMI data for March suggests that this process could face challenges in the future.

The PMI index for the manufacturing sector has been fluctuating within a certain range and hovering in the critical zone since the outbreak of the COVID-19 pandemic. Despite the tweak of China's COVID-19 policies, this trend has persisted. In February, the manufacturing sector achieved a high of 52.8%, but the degree of recovery declined again in March, falling by 0.7 percentage points from the previous month. The PMIs of large, medium, and small enterprises were 53.6%, 50.3%, and 50.4%, respectively, with small and medium-sized enterprises showing weaker prosperity levels than larger enterprises. This data is consistent with the recent announcement of a significant decline in industrial enterprise profits. The continued recovery of small and medium-sized enterprises faces some uncertainty, indicating that the recovery of the Chinese market ecology is not exactly optimistic.

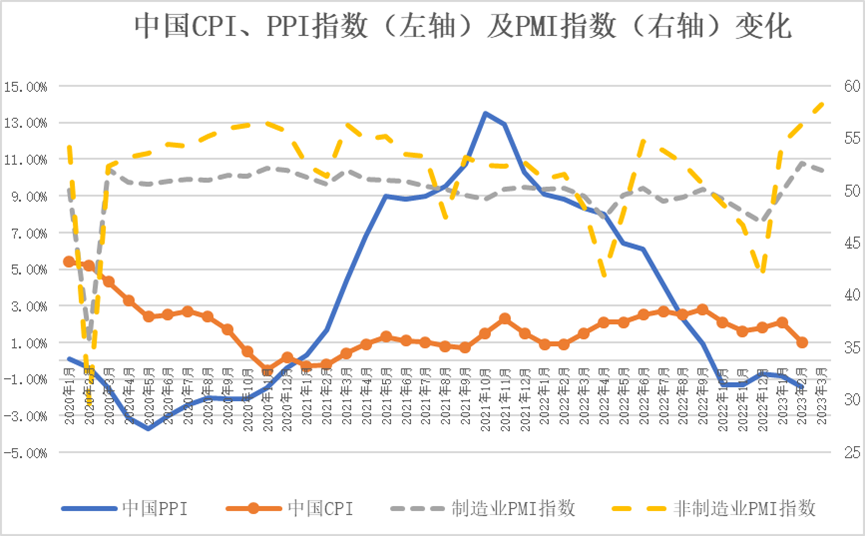

Figure: CPI & PPI (Left) and PMI (Right) Changes in China

Source: National Bureau of Statistics. Chart plotted by ANBOUND.

Looking at the sub-indices, the production index and the new order index of the PMI in March were 54.6% and 53.6%, respectively. They remained relatively high in recent months but showed a decline of 2.1 and 0.5 percentage points, respectively, from the previous month. Among them, the new export order index in the new order index was 50.4%, indicating a downward trend due to the pressure of external demand, compared to the previous value of 52.4%. The employment index declined by 0.5 percentage points from the previous month to 49.7%, indicating a slight decline in the employment level of manufacturing companies. Therefore, it can be inferred that the industry's recovery shows signs of an insufficient rebound after the initial recovery.

According to the researchers at ANBOUND, these data demonstrate that the recovery of enterprises and the market is a gradual process, and during this process, residents and enterprises need time to recuperate. The lack of sustainable demand is still a significant factor that restricts the growth of the manufacturing industry. Considering the current low level of inflation and the global supply chain adjustments that the manufacturing industry is presently facing, the reasons for restricting the development of industrial manufacturing in China come from both the supply and demand sides.

As it stands, China's economy shows cautious optimism as well, particularly in the non-manufacturing sector. The continued rise of the non-manufacturing PMI index suggests a strong recovery in the service industry, which to some extent compensates for the weakness in the manufacturing industry's recovery. The service industry is expected to be a major driving force in this year's economic recovery for the country. In March, the non-manufacturing business activity index rose to 58.2%, an increase of 1.9 percentage points from the previous month, indicating a sustained upward trend since the pandemic. The business activity index for the service industry also rose to 56.9%, an increase of 1.3 percentage points from the previous month. Among industries, the business activity index for retail, railway transportation, road transportation, air transportation, internet and information technology services, monetary financial services, leasing and business services, etc. were above 60.0%. On the other hand, the business activity index for wholesale and water transportation was below that critical point. The new order index rose to 57.3%, an increase of 1.5 percentage points from the previous month, surpassing the critical point and indicating a continued rebound in demand in the non-manufacturing market. However, the employment index fell to 49.2%, a decrease of 1.0 percentage point from the previous month, suggesting a slight decline in the employment level of non-manufacturing companies.

Although the comprehensive PMI index reflects that the economic situation continues to improve and is still on the path of moderate recovery, the changes in economic structure have made the recovery of non-manufacturing industries, which are mainly composed of the service sector, more evident than that of the manufacturing industry. The manufacturing industry has shown signs of slowing down and is in danger of falling back into overcapacity. Researchers at ANBOUND pointed out that in evaluating China's economic recovery this year, the focus cannot mere merely be on the rebound of life services and transportation, and it is also necessary to pay attention to the performance of industrial enterprises. Relying solely on the service industry as a driver makes it difficult to promote overall economic growth. All in all, this indicates that China's economy still faces many challenges and pressures this year.

Final analysis conclusion:

In March, China's manufacturing PMI decreased by 0.7 percentage points from the previous month to 51.9%, suggesting a loss of momentum despite still being in the expansion zone. Conversely, the non-manufacturing business activity index rose by 1.9 percentage points from the previous month to 58.2%, displaying a persistent upward trend after the pandemic. The disparity in the performance of the manufacturing and non-manufacturing sectors implies a less-than-optimistic outlook for China's overall economic recovery this year.