On September 7, China's General Administration of Customs released the country's foreign trade data for August, which provides insight into the current state of its foreign economy.

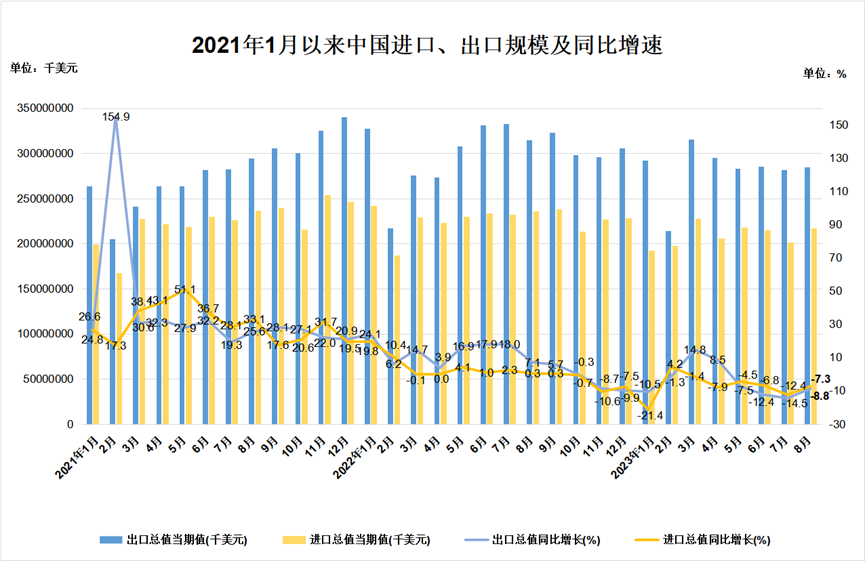

According to the data, in terms of USD, China's exports in August experienced a year-on-year decrease of 8.8%. However, this decline narrowed by 5.7 percentage points compared to July, marking a reversal in the trend of continuous export decreases seen in the past two months, reaching levels not seen since March 2020. Imports also saw a year-on-year decrease of 7.3% in August, with the decline narrowing by 5.1 percentage points compared to July. The trade surplus for the month amounted to USD 68.36 billion, which was USD 12.24 billion lower than in July. It is evident that exports and imports for August still experienced negative year-on-year growth, although the decline was less pronounced.

Figure: Changes in China's Foreign Trade since 2021

Source: General Administration of Customs. Chart plotted by ANBOUND.

Due to the recent continuous depreciation of the Chinese yuan, or renminbi (RMB) against the USD, the year-on-year decline in imports and exports calculated in the Chinese currency is lesser than when calculated in the dollar. In August, exports calculated in RMB decreased by 3.2% year-on-year, narrowing the decline by 6.0 percentage points. Imports calculated in the same currency decreased by 1.6% in August, narrowing the decline by 5.3 percentage points. The trade surplus for the month was RMB 488.8 billion, lower than the RMB 869.0 billion in July. It can be seen that even though the depreciation of the RMB has eased the decline in China's import and export data, both export and import data continue to show negative growth.

Official institutions have offered a much more optimistic interpretation of the latest foreign trade data from different perspectives. The General Administration of Customs stated that in the first eight months of this year, China's total foreign trade import and export value was RMB 27.08 trillion, a slight decrease of 0.1% year-on-year but still at a historically high level. Among these, exports were RMB 15.47 trillion, an increase of 0.8%, while imports were RMB 11.61 trillion, a decrease of 1.3%. When comparing the cumulative data for the first eight months with the depreciation effect calculated in RMB (which has depreciated by over 8.8% since its strongest point against the USD on January 16 this year), it smooths out the decline in China's goods trade import and export growth rate. Therefore, conclusions like "overall at a historically high level" and "monthly imports and exports are generally stable" can be drawn.

Researchers at ANBOUND believe that the official interpretation is more of like seeing optimistic development in gloomy circumstances, and may not objectively point out that China's foreign trade situation still faces the challenging reality of significant negative growth.

In foreign trade, the data that contributes to economic growth is trade surplus (net exports). In Chinese currency, the trade surplus in August amounted to RMB 488 billion, narrowing by 8.2% year-on-year. In the dollar, it was USD 68.36 billion, narrowing by 13.2% year-on-year. When calculating cumulative data for the first eight months, in RMB terms, the trade surplus for the first eight months was RMB 3.86 trillion, expanding by 7.3%. In USD terms, it was USD 553.4 billion, expanding by 0.8%. If the downward trend in foreign trade continues for the rest of the year, the country's trade surplus for the year may further decrease, leading to a continued reduction in its contribution to economic growth.

In the latest trade data, the changes in the trade volume between China and its major trading partners clearly reflect the influence of the recent geopolitical and geo-economic frictions.

In the first eight months, ASEAN was China's largest trading partner, with a total trade value of RMB 4.11 trillion, an increase of 1.6%, accounting for 15.2% of China's foreign trade total. Among these, exports to ASEAN amounted to RMB 2.4 trillion, an increase of 2.8%, while imports reached RMB 1.71 trillion, a slight increase of 0.03%. China's trade surplus with ASEAN expanded to RMB 685.2 billion, a 10.3% increase.

The European Union was China's second-largest trading partner, with a total trade value of RMB 3.68 trillion, a decrease of 1.5%, accounting for 13.6% of China's foreign trade total. Exports to the EU amounted to RMB 2.37 trillion, a 4.4% decrease, while imports increased to RMB 1.31 trillion, up by 4.3%. China's trade surplus with the EU narrowed to RMB 1.06 trillion, a 13.4% decrease.

The United States was China's third-largest trading partner, with a total trade value of RMB 3.05 trillion, a decrease of 8.7%, accounting for 11.2% of China's foreign trade total. Exports to the U.S. amounted to RMB 2.27 trillion, a decrease of 11.7%, while imports reached RMB 775.26 billion, an increase of 1.6%. China's trade surplus with the U.S. narrowed to RMB 1.5 trillion, a 17.4% decrease.

Japan is China's fourth-largest trading partner, with a total trade value of RMB 1.45 trillion, a decrease of 6.8%, accounting for 5.4% of China's foreign trade total. Among these, exports to Japan amounted to RMB 724.34 billion, a 2.4% decrease, while imports were RMB 724.64 billion, a 10.7% decrease. China's trade deficit with Japan narrowed to RMB 3 million, a 99.6% reduction.

Looking at the month of August alone, due to a lower base last year, China's exports to the U.S., the EU, and ASEAN saw narrower declines, but they still remained weaker overall. Specifically, exports to these three regions decreased by 9.5%, 19.6%, and 13.3%, respectively, with narrowing declines of 13.6%, 1.0%, and 8.2% percentage points. However, the decline in exports to Japan expanded by 1.8 percentage points to 20.1%, while export growth to Russia continued to slow, dropping significantly by 68.2 percentage points to 37.3% in August.

It can be projected that the ASEAN region's position in China's foreign trade will continue to rise, while China's trade relations with its main Western trading partners have all declined to varying degrees. In the first eight months of foreign goods trade, the country's exports to the EU. The U.S., and Japan all experienced negative growth. Among them, the largest decline was seen in exports to the U.S., with an 11.7% decrease, followed by an 8.7% decrease in trade value. The proportion of China's trade values with the EU, the U.S., and Japan in foreign trade have all declined to varying degrees. This shift in trade relations with its major trading partners shows a strong correlation with China's geopolitical relations with these partners. It is evident that changes related to geopolitics, adjustments in supply chain relationships, and changes in foreign investment are increasingly evident in trade relationships.

Final analysis conclusion:

Overall, China's foreign trade decline continues, although the trade surplus for the first eight months is still showing positive growth (expanding by 7.3% in RMB terms and only 0.8% in USD terms). Whether the annual trade surplus can maintain year-on-year positive growth remains to be seen. Given the impact of multiple factors such as geopolitics, supply chain adjustments, shifts in foreign investment, and ongoing tariff barriers, China's external economic situation remains challenging. Taking all factors into account, it is likely that external demand will make a negative contribution to its economic growth this year.