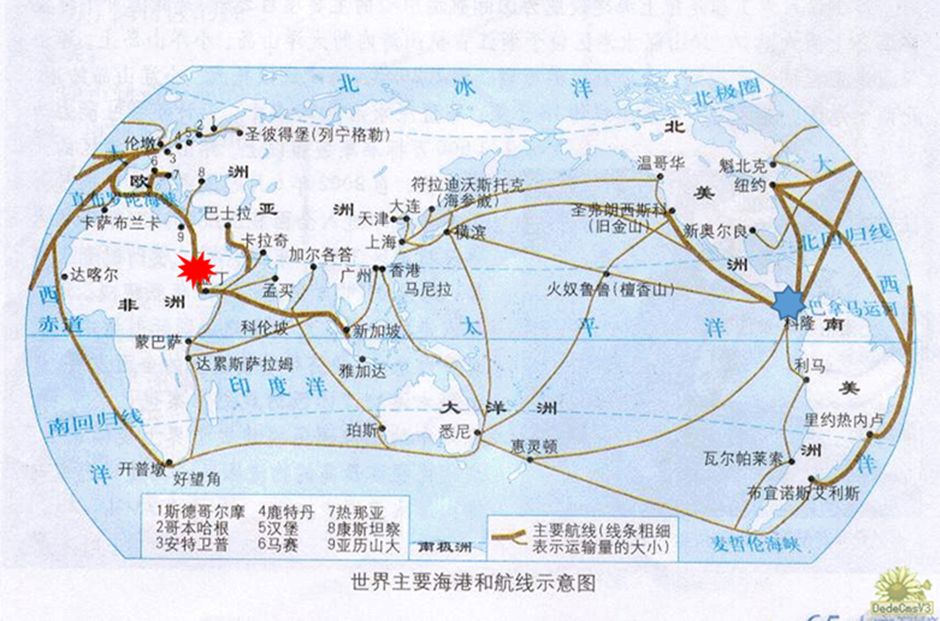

The chain reaction triggered by the geopolitical crisis in the Red Sea is deepening, impacting the global shipping market and supply chain system. Since mid-December 2023, Houthi insurgents in Yemen have been attacking vessels, thereby blocking this vital passage in the Red Sea. So far, over a hundred container-laden ships have been forced to detour around the southern tip of Africa, resulting in a significant increase in transit times and transportation costs in less than a month.

Image: Disruption in Global Shipping Due to Blockage of Two Key Canals

Source: Shipping Online

According to data cited by Securities Times, a national financial newspaper in China, the energy intelligence agency Vortexa’s data indicate that if commercial ships detour around the Cape of Good Hope in Africa, the sailing time on major routes from the Middle East to Europe and from India to Europe will increase by 58% to 129%. Among them, the route with the greatest increase in the time required for goods to reach their destination is from the Arabian Gulf to the Mediterranean, with a rise of 129%, an increase from 17 days to 39 days.

The change in routes has led to a surge in transportation costs. The world's four major shipping companies—Maersk, Hapag-Lloyd, Mediterranean Shipping Company (MSC), and CMA CGM—have all raised prices due to logistics congestion. According to the latest real-time freight data provided by GeekYum, taking the example of the route from Shanghai port to Hamburg port in Germany in January, various shipping companies have different quotations. Among them, the 352W voyage under MSC offers a price of USD 5540/TEU (twenty-foot equivalent unit), the 401W voyage under Maersk quotes USD 4703/TEU, and the 0690-047W voyage under Evergreen quotes USD 5260/TEU. The voyage 0FLGPW1MA under CMA CGM even quotes a high price of USD 7077/TEU on January 16. As for the shipping index, data from the Shanghai Shipping Exchange shows that as of December 29 last year, the Shanghai containerized freight index was 1759.6 points, an increase of 40.2% from the previous period.

China is a significant demander on the Asia-Europe shipping route. Starting from Chinese ports, passing through Singapore, crossing the Indian Ocean toward the Red Sea, and then entering Europe through the Suez Canal, this maritime route is a crucial passage for the interchange of Chinese goods with the European market. The current blockage on this route has led to a sharp increase in shipping prices for Chinese goods to Europe. According to Securities Times, for small household appliances exported from Foshan, Guangdong, to Europe, the price for shipping four containers from China to Morocco has increased by several hundred thousand yuan compared to early December last year. This is equivalent to customers having to pay an additional USD 2 to USD 3 for each small household appliance. Shenzhen-based EasySpeed Supply Chain stated that the price for sending one container used to be USD 2300 to USD 2400, and now it is conservatively estimated to be around USD 6500. Calculated this way, the increase in freight rates is as high as 170.8% to 182.6%.

According to some Chinese media, a Shenzhen supply chain management company handling import and export business for foreign trade enterprises mentioned that due to Chinese goods bound for Europe being forced to detour around the Cape of Good Hope, both the journey and time have increased significantly, leading to a substantial rise in shipping costs. With extended delivery cycles, it is estimated that future orders will decrease.

As the Red Sea crisis continues, the impact on maritime shipping and the supply chain system of the China-Europe route is deepening. One significant consequence is that changes in the transportation process are starting to disrupt the production order of businesses. Industry insiders believe that if the crisis continues to escalate and the ceasefire period remains uncertain, the increase in shipping costs and extended delivery cycles due to maritime detours may lead to two extreme situations for buyers. One scenario is that due to the inability to shelf and sell goods on time, some European buyers may abandon, reduce orders, or decrease demand. The other scenario is that, as European buyers do not have the habit of stocking up in advance, some may increase purchasing plans in the near term, leading to a short-term increase in demand. Lin Wensheng, Executive Vice President of the Shenzhen Chamber of Commerce for Import & Export Services, analyzed that regardless of which situation arises, it will disrupt the normal production and shipping rhythm of businesses to some extent. If purchases increase, manufacturers will need to increase procurement funds to buy more raw materials, leading to higher operating costs for factory funds. If orders suddenly decrease, the pre-purchased raw materials will accumulate, warehouse rents will increase, and workers will be unable to work, especially for contract manufacturers. The issue is whether to continue production when the goods have not been delivered. Thus, although it seems to only disrupt the logistics rhythm on the surface, it actually disrupts the entire supply chain order.

The Red Sea crisis has caused changes in the logistics methods of businesses. In terms of transportation methods and routes, in addition to still choosing sea routes around the Cape of Good Hope, some companies have opted for a combination of air and sea transportation. This involves initially shipping goods by sea to the Middle East and then transporting them by air to the destination from there. In addition, some customers with more urgent shipping needs may choose air transport or China-Europe freight trains. According to Securities Times, the capacity of China-Europe freight trains for January has already been fully booked, with the earliest booking service date on SOFreight's website now extending to January 31.

However, China-Europe freight trains or air transport is mostly for goods with high time requirements and added value. Generally, products transported by sea include low-value-added items such as daily necessities, clothing, and footwear. These products are shipped in large quantities, but with thin profit margins, it is likely challenging to cover the costs of China-Europe freight trains and air transport. In addition, compared to the vast cargo capacity of sea shipping, the capacity of China-Europe freight trains is limited and cannot effectively address the impact caused by the obstruction of sea routes.

Unfortunately, while the Suez Canal-Red Sea route is blocked, another crucial canal globally, namely the Panama Canal, is now facing challenges due to drought. Currently, the water level of the Panama Canal is 1.8 meters lower than normal, and the Panama Canal Authority has restricted the number of vessels that can pass to 24 per day. With the dry season approaching, the transit conditions of the Panama Canal are expected to become even less optimistic. As the dry climate is disrupting this waterway that handles USD 270 billion in global trade annually, industry experts believe that there is no simple solution to the current problems. Faced with rising risks and freight costs, shipping companies are attempting to pass on the additional costs to customers. In recent months, major shipping companies, including Hapag-Lloyd, MSC, and Maersk, have announced new surcharges related to the Panama Canal.

Undoubtedly, the blockage of the Suez Canal and the Panama Canal, the two major trade arteries, is significantly impacting global trade activities. As the blockage persists, the global trade system and supply chains seem to be experiencing a level of disruption reminiscent of the impact during the early days of the COVID-19 pandemic. Inga Fechner, a senior economist at ING, a Dutch financial service provider, pointed out that in the long run, higher transportation costs will have a trickle-down effect, and it will ultimately hit consumers.

China is a major global trading nation, with the highest volume of goods traded worldwide. For example, in 2022, the total value of China's imports and exports was USD 6.31 trillion, with exports at USD 3.59 trillion, imports at USD 2.72 trillion, and a trade surplus of USD 877.6 billion. China's share of global trade is approximately 12.5%. It is noteworthy that in 2022, its exports to the European Union amounted to USD 561.9 billion, accounting for over 15% of China's total exports. 60% of the country's exports to Europe pass through the Suez Canal. It is evident that China is a significant victim in the process of the Suez Canal blockade caused by the Red Sea crisis. From trade to production chains, China's supply chain system related to Europe will be noticeably affected.

Final analysis conclusion:

The chain reactions triggered by the geopolitical crisis in the Red Sea are deepening, causing a significant impact on the global shipping market and supply chain system. As it stands, in this disruption felt by the Suez Canal route, China emerges as a crucial victim.