On January 17 this year, China's National Bureau of Statistics (NBS) released the economic data for the year 2023. The data shows that the Chinese economy grew by 5.2% year-on-year (y-o-y); fixed asset investment (excluding rural households) increased by 3.0% y-o-y, with private fixed asset investment decreasing by 0.4% y-o-y; the total retail sales of consumer goods increased by 7.2% y-o-y. The total import and export of goods increased by 0.2% y-o-y. Specifically, exports increased by 0.6% y-o-y, while imports decreased by 0.3% y-o-y. The national urban survey unemployment rate averaged 5.2%, a decrease of 0.4 percentage points compared to the previous year.

Overall, considering the implementation of various policies and significant resource inputs in 2023, the economic growth of 5.2% met the target set the previous year, making the data relatively balanced. However, given the strenuous efforts made to stabilize the economy, the economic recovery of the previous year was still challenging.

In comparison to economic data, researchers at ANBOUND believe that a more crucial focus should be on the living conditions of the Chinese people, including issues such as birth rate, death rate, aging rate, as well as income and employment reflecting the situation of the ordinary citizens.

Population issues loom large. According to the NBS, at the end of 2023, the national population (including the population of 31 provinces, autonomous regions, direct-controlled municipalities, and active-duty military personnel, excluding residents of Hong Kong, Macao, Taiwan, and foreigners) was 1,409.67 million, a decrease of 2.08 million from the end of the previous year. The annual birth population was 9.02 million, with a birth rate of 6.39‰; the death population was 11.10 million, with a death rate of 7.87‰; the natural population growth rate was -1.48‰.

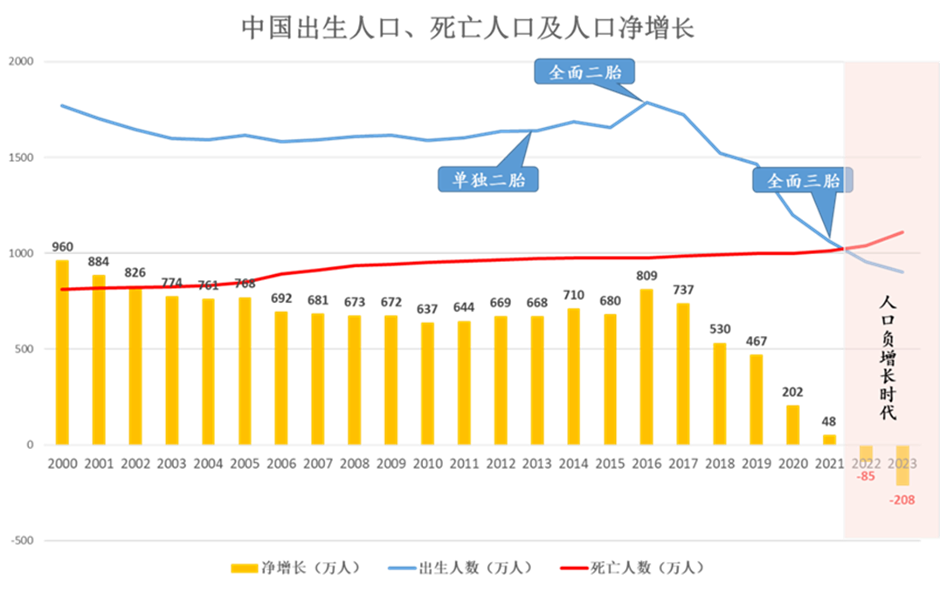

The most immediate significance of population data is that there are fewer newborns and more deaths, indicating that China has entered an era of negative population growth. In fact, the net decrease in China's population is not a new phenomenon. In 2022, the country had a net decrease of 850,000 people, with 9.56 million births and 10.41 million deaths. In 2023, the net decrease surged to 2.08 million people, a significant increase of 145% compared to the previous year, with 9.02 million births and 11.10 million deaths.

Since the beginning of the 21st century, the basic trend of China's annual net population growth has been declining. However, there was a brief phenomenon of increased birth rates and net population growth after the introduction of the "Two-Child Policy" in 2013 and the "Universal Two-Child Policy" in 2016. Starting from 2017, the number of births in China rapidly declined, while the death rate slowly increased, leading to a significant decrease in net population growth. In just six years, the net population growth dropped from 8.09 million in 2016 to a negative growth of 850,000 in 2022. Since 2022, China has entered an era of negative population growth. Researchers at ANBOUND predict that the trend of negative population growth in China will persist in the long term, with the gap widening, lasting at least until the peak of aging in the mid-21st century.

Figure: China Now Enters the Era of Negative Population Growth

Source: National Bureau of Statistics. Chart Plotted by ANBOUND.

Looking at the age composition of the population, in 2023, the labor force population aged 16-59 was 864.81 million, accounting for 61.3% of the national population; the population aged 60 and above was 296.97 million, representing 21.1% of the national population, with 21.76 million people aged 65 and above, accounting for 15.4% of the national population. From the perspective of age composition, China is facing the issues of a decreasing labor force population and a continuously rising aging rate, rapidly moving towards a society of deep aging and super-aging. The macro significance of the changing age composition lies in the reduction of the working-age population, a decrease in the population that creates economic wealth, an increase in the degree of societal aging, and a growing burden of aging for China. All these put pressure on the country's social security, healthcare, and elderly care. If China's technological progress and efficiency remain unchanged, this will inevitably make both economic and social development unsustainable. Analysts at ANBOUND have previously pointed out that aging is the largest long-term drag on China's economic development, and now the naiton is rapidly entering this process, which will last for decades.

Looking at the urban-rural composition of the population in 2023, China's urban population was 932.67 million, a rise of 11.96 million from the previous year, while the rural population was 477 million, a drop of 14.04 million. The urban population accounted for 66.16% of the total national population, an increase of 0.94 percentage points from the previous year. The total number of migrant workers for the year was 297.53 million, an increase of 1.91 million from the previous year, with a growth rate of 0.6%. Among them, local migrant workers were 120.95 million, a decrease of 2.2%, while migrant workers working outside their hometowns were 176.58 million, an increase of 2.7%. Although urbanization in China has reached the second half, the urbanization rate is still increasing. However, it is essential to note that, during this process, China's urbanization is facing increasingly more "quality" issues. Analysts at ANBOUND proposed years ago that for a developing large country like China, a higher urbanization rate is not necessarily better. In fact, there is a "critical point" (such as 50%) for the urbanization rate in developing countries. Beyond this critical point, the problems and risks may outweigh the benefits (Kung Chan, 2012). Due to the inability of the urban economy and public service system to support the integration needs of a large number of new urban residents, China's urbanization is to some extent not fully prepared for such outcomes. Many rural residents work in cities when they are young but withdraw from urban areas as they age. Slowing down the pace of urbanization and addressing unpreparedness may be the pressing reality that China needs to solve in the next phase of urbanization.

Employment and income levels are important indicators for measuring the quality of life for the population. Since the outbreak of the COVID-19 pandemic, employment pressure in China has become prominent. According to NBS's data, the average urban survey unemployment rate in China was 5.2% in 2023, a decrease of 0.4 percentage points from the previous year. The labor force survey unemployment rates for individuals aged 16-24, 25-29, and 30-59, excluding students, were 14.9%, 6.1%, and 3.9%, respectively. Regarding unemployment rate data, the relevant authorities have generally adopted more of an avoidance attitude. For instance, the youth unemployment rate for individuals aged 16-24 was too high and alarming, so the NBS excluded students to make the data look better. While there is some rationale for excluding students from unemployment statistics, over 10 million college graduates still need to find jobs each year, and the reliability of employment rates from universities is low. The accuracy of future unemployment rate data remains to be observed.

In terms of residents' income, the per capita disposable income for Chinese residents in 2023 was RMB 39,218, with a real growth of 6.1% after deducting price factors. The per capita disposable income for urban residents was RMB 51,821, with a real growth of 4.8%, while the per capita disposable income for rural residents was RMB 21,691, with a real growth of 7.6%. The median per capita disposable income for Chinese residents was RMB 33,036, a nominal increase of 5.3% from the previous year. The proportion of per capita food, tobacco, and alcohol consumption expenditure to total per capita consumption expenditure (Engel coefficient) was 29.8%, a decrease of 0.7 percentage points from the previous year. The per capita service consumption expenditure for Chinese residents increased by 14.4%, accounting for 45.2% of total per capita consumption expenditure, an increase of 2.0 percentage points from the previous year. Although the per capita disposable income for Chinese residents grew faster than the GDP growth rate, it is noteworthy that the growth rate of per capita disposable income (4.8%) was lower than the economic growth rate (5.2%), failing to achieve the target set in the government work report. Considering the current economic situation, employment status, and future development trends, income issues for urban residents may significantly impact future consumption recovery.

Final analysis conclusion:

The core of economic development should revolve around improving people's welfare. When evaluating whether China's economy is experiencing high-quality development, in addition to many official development indicators, we believe more consideration should be given to the life, aging, illness, and survival quality of ordinary Chinese people. From this perspective, we may see different stories behind the economic data.